EQx is a Political Economy

Global Index

The Index ranks the world’s countries by Elite Quality. Elite Power – i.e. the ability of elites to set up extractive business models in the future – as well as actual Value Creation vs Extraction in the Economic and Political dimensions, are measured on the basis of dozens of Indicators.

How is the Index Structured ?

The Index is based on a 4-level architecture allowing for both an overall quantification of a country’s EQx, as well as an in-depth analysis of specific political economy dimensions.

EQx Levels in Depth

Explore each level, its logic and components.

Index

Level 1

Elite Quality Index (EQx)

What is the concept behind our Index?

Let’s assume that elite`s business models are key determinants of a nation’s future prosperity and human welfare. In any political economy, there are essentially two kinds of business models; on one hand, Value Creation models like new biotech drugs developed by innovative pharma or start-ups. On the other, Value Extraction models and rent seeking models, such as monopolies or trade barriers that result in higher prices. In 2019, Martin Wolf, Chief Economist of the Financial Times, suggested in a memorable FT article that even in liberal democracies there might be plenty of rent seeking models by “rentier capitalists”.

The EQx Index aims to operationalize political economy concepts by equating them to actual levels of Value Creation and Rent Seeking.

Sub-Indices and Index Areas

Level 2

Power

Value

The Index can be divided in 2 Sub-Indices: Power and Value. Power is seen as a necessary condition for Value Extraction and rent seeking since Value Extraction business models require Power to operate. The Power Sub-Index I is thus the indicator of potential future Value Extraction.

Both Sub-Indices in turn include a Political and an Economic Dimension. This yields 4 Index Areas: on the Power Sub-Index, Political Power (i) and Economic Power (ii); on the Value Sub-Index, Political Value (iii) and Economic Value (iv).

Pillars

Level 3

The 12 EQx Pillars each capture a specific element of the Economic and Political Power/Value complex present in our countries. The purpose of the Pillars is to define and form conceptual lenses through which we can approach, understand and measure specific phenomena. They comprise a weighted sum of expertly chosen Indicators which numerically evidence present or future potential Value Creation or rent seeking.

Each Pillar is conceptually consistent with one of the four Index Areas. Each of the 3 Pillars forming an Index Area has been assigned its own weight within its Index Area.

Political Power (i)

State Capture (i.1)

Regulatory Capture (i.2)

Human Capture (i.3)

Economic Power (ii)

Industry Dominance (ii.4)

Firm Dominance (ii.5)

Creative Destruction (ii.6)

Political Value (iii)

Giving Income (iii.7)

Taking Income (iii.8)

Unearned Incomen (iii.9)

Economic Value (iv)

Producer Rent (iv. 10)

Capital Rent (iv.11.)

Labor Rent (iv.12)

Indicators

Level 4

Indicators are the underlying datasets from which the Index is constructed. The datasets are collected, conceptually validated and collated. They mainly come from renowned international organisations such as the World Bank and the IMF, the finance industry or other indices. Selected Indicators are developed by the EQx team of researchers and collaborators. Each Indicator is based on a specific dataset quantitatively capturing Power, as well as Value Creation vs. Extraction phenomena in the political economy.

The EQx2020 is based on 107 Indicators. The new incorporation, adjustment and update of Indicators, as well as the elimination of unsatisfactory datasets, is a fundamental part of the ongoing EQx research project. For details on single EQx Indicators such as the rationale behind their inclusion in the Index, please consult the EQx Indicators Table.

Methodology

EQx is an ongoing research project

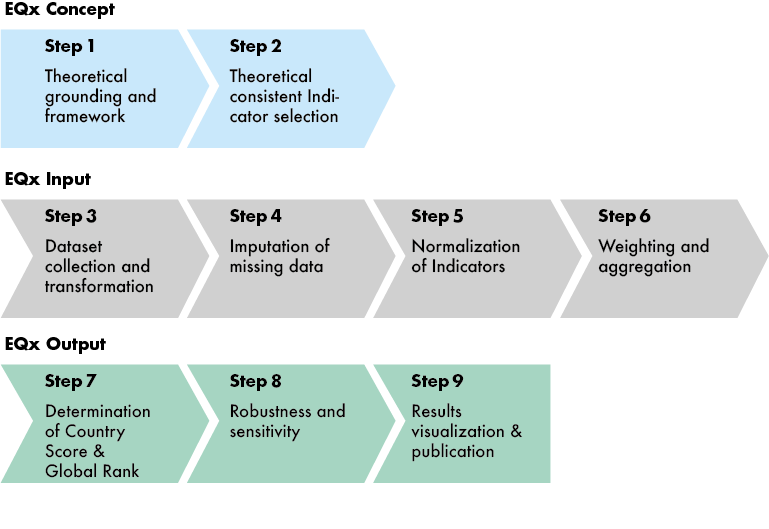

In the initial ‘Concept’ phase (2 steps), EQx constructs, architecture and theoretical aspects are developed.

The ‘Input’ phase (4 steps) starts with the collection of the datasets underlying individual EQx Indicators. These are selected on the basis of a theoretical fit and culled from diverse sources. The datasets then undergo methodological transformation, normalization, aggregation and weighting procedures.

The ‘Output’ phase (3 steps) sees the determination of the EQx Country Scores and Global Rank. The final phase includes statistical testing and validation, followed by the publication of results.

The Elite Quality Index (EQx) applies a methodology grounded in relevant academic literature. EQx’s methodological position is described in the Methodology Paper, available for reference and review by pressing the download button below. Criticism and comments are very welcome.

You can write us at research@elitequality.org